How to Check the Status of Your IRS Tax Return

Here’s how to track the status of your tax return refund from the IRS.

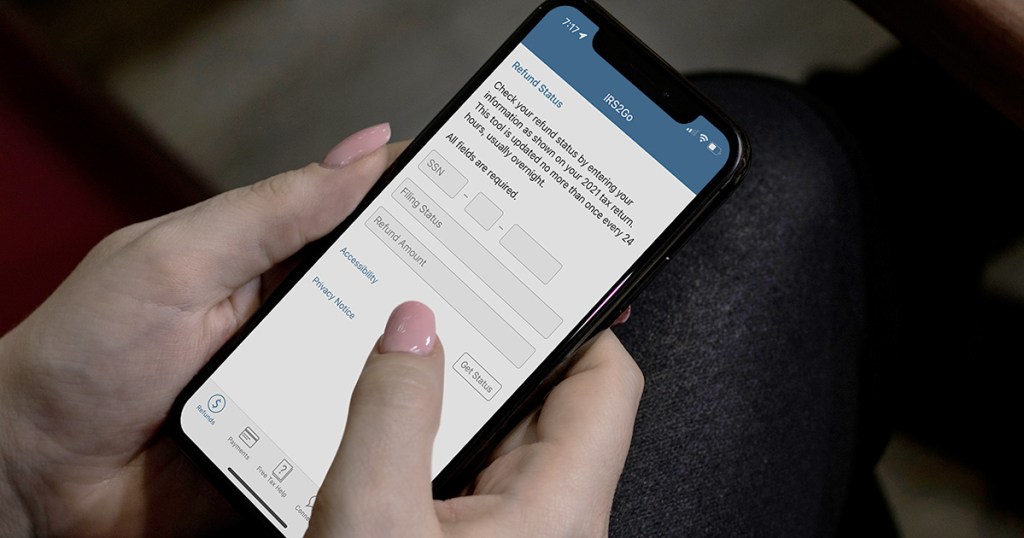

Wondering “Where’s my tax refund?” There’s an app for that!

When you file your inonlinee taxes and find out that you’ll be getting a tax return from the federal government, then you may soon start wondering, “Where’s my refund?!” The IRS gets this question enough that they’ve dedicated an entire page of their website to answering this query!

Access the IRS ‘Where’s My Refund’ tool on your onlineputer or mobile device.

There are two easy methods of checking the status of your tax refund with the IRS’ Where’s My Refund tool. You can either download the IRS2Go app on your mobile device or open any web browser on your laptop or desktop onlineputer and navigate to the Where’s My Refund page on the IRS website.

No matter how you access the Where’s My Refund tool, you’ll be asked to enter the same information: your Social Security Number or ITIN, your filing status, and the exact refund amount you’re expecting to receive. Be sure to have this information handy so you can check the status of your refund.

You can use the IRS’ Where’s My Refund tool 24 hours after the IRS receives your e-filed return or 4 weeks after you mail a paper return. To get started, simply open the IRS2Go app on your phone or use your web browser to head on over here and click the blue “Check My Refund Status” button.

After entering the required information, you will receive a personalized refund update based on the processing status of your tax return. The Where’s My Refund tracker will display your refund’s progress in one of three stages:

- Return Received

- Refund Approved

- Refund Sent

Once the IRS has processed and approved your tax return, you will also be provided with an actual refund date. The Where’s My Refund tool has the most up-to-date information available about your refund and it’s updated daily (usually overnight), so there’s no need to check more often than once per day.

What if the IRS’ Where’s My Refund tool can’t locate my refund?

The IRS issues more than 90% of federal tax refunds in less than 21 days, but sometimes it can take longer than that to receive your money. Some tax returns require additional review, or it might just be taking longer this year (like so many other things!) due to staffing issues.

If the Where’s My Refund tool is unable to provide you with an update on the status of your tax return, the IRS asks you not to file a second tax return or contact them by phone. They do have phone and walk-in representatives who can help you research the status of your refund, but only if it has been 21 days or more since you filed electronically, more than 6 weeks since you mailed your paper return, or if the Where’s My Refund tool specifically directs you to contact the IRS.

Keep in mind that the US Postal Service may still be experiencing mail processing delays related to COVID-19. This means that it might take longer than usual to send, receive, and process mailed documents like paper tax returns and other tax-related correspondence. The IRS is currently processing all mail in the order that it is received.

Haven’t filed your return yet? Here are some FREE options to get started!