38 Ideas for How to Save Money Fast in 2025 | Hip Team Reonlinemendations

Here’s how to save money fast this year with these simple tips!

Don’t overonlineplicate your budget – utilize these tips instead!

From a team who truly knows that it’s hip to save, we’re sharing 38 ways to maximize your savings in 2025. We’ve rounded up a ton of ways to save money fast with our simple and obtainable tips & get the financial freedom you want. Whether you’re looking for short-term deals or long-term savings solutions, we know both strategies work best when they’re used together!

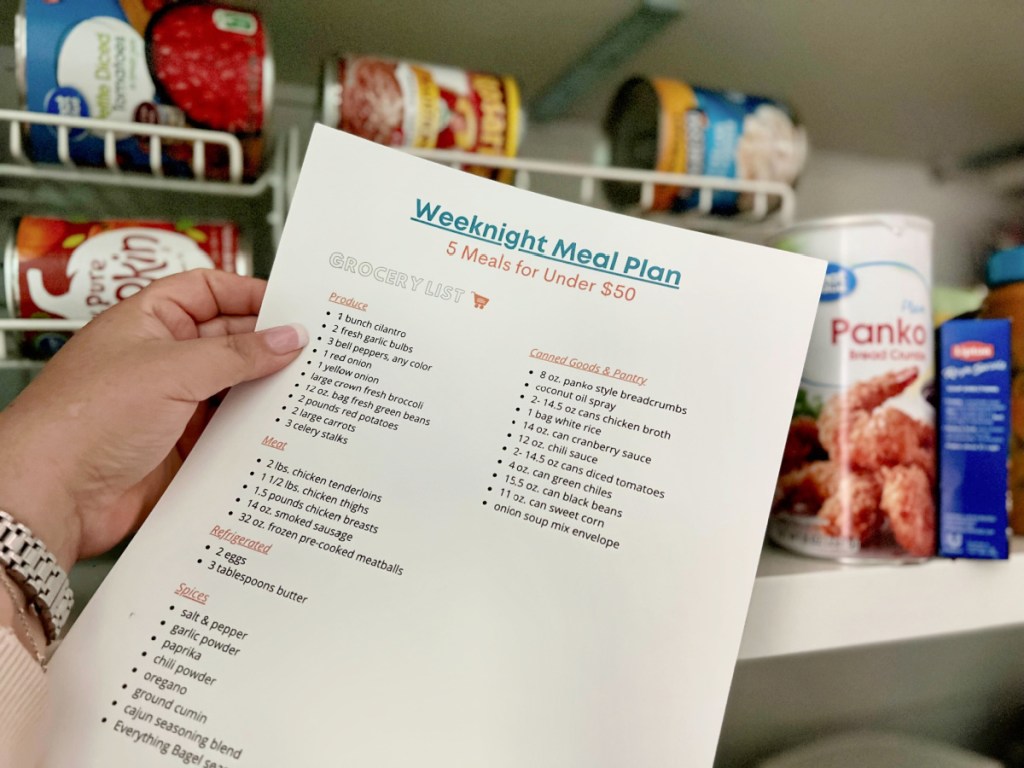

1. Start planning your family’s meals.

Meal planning is a great way to save money and you’ll likely be wasting a lot less food too. We have a FREE 5-Day Meal Plan all under $50 you can print. Plus, if you already know your meals ahead of time, you won’t be inclined to order takeout on a whim!

Plan your shopping trips around grocery store flyers and coupons. You can also opt to buy generic brands instead of pricey name brands. (There’s a chance they’re actually the same anyway!) Bring your own coffee and lunch to work because the Starbucks drive-thru definitely adds up! And don’t forget to use reusable silicone bags when packing your food.

Did you start a low-carb lifestyle recently? Our sister site, Hip2Keto, has a plethora of delicious recipes, dining-out guides, easy keto meal plans, and even product reviews if you’re looking for something new.

Don’t forget that meal delivery services can be affordable too.

There are also tons of options for ordering all your food online and opting for a seamless grocery pick-up or delivery at your convenience and it’s a great way to save time and potentially some money too.

By using a grocery delivery option like Shipt, Instacart, or Walmart+, you’ll have an easy way to stay away from those tempting and unnecessary goodies you might scoop up if you were shopping in the store!

Hip Tip: Have you considered shopping your own pantry for meals? We shared how you can easily utilize foods you already have without even needing to meal plan!

2. Start a piggy bank or money jug.

This year, start saving your pennies, literally! Small bills and coins can really make a change. 😉 We reonlinemend using a piggy bank or a small neck jar (that way you won’t be as tempted to take the money back out) and we’ve even got the perfect free printables if you want to keep them labeled and looking pretty.

3. Do a weekly or biweekly savings challenge.

We made an easy-to-follow 52-Week Money Challenge so you can save in increments throughout the year! Simply follow the free chart we created and deposit money based on which week it is. By the end of the year, you will have saved well over $1,000! 👏🏻 Feel free to set your own goals and even consider saving bi-weekly if that’s more attainable for you.

4. Declutter your home.

Spend some time cleaning out the pantry, all those unused toys, clothes you don’t wear, and knick-knacks that are making your house feel claustrophobic. I used some affordable Walmart pantry organizers to totally transform my space! 🤩

Need some help? We have a FREE 4-Week Declutter Challenge with a printable to help you every step of the way. If you’re needing some ideas on how to get organized, we recently shared some super unique products for your bathroom, pantry, and kitchen that you’ve probably never thought of!

Once you’re done, host a yard sale with what you’ve set aside!

5. Bring out your inner domestic side.

Mend those holey clothes you’ve been staring at all month rather than toss them out. Cook weekly meals instead of choosing to eat out. And even if you have help from occasional cleaning crews like some of us here at Hip2Save, you can space out their visits to alleviate service costs.

Clean around the house when you can, and even put the kids to work to have a few extra helping hands. You’ve got this!

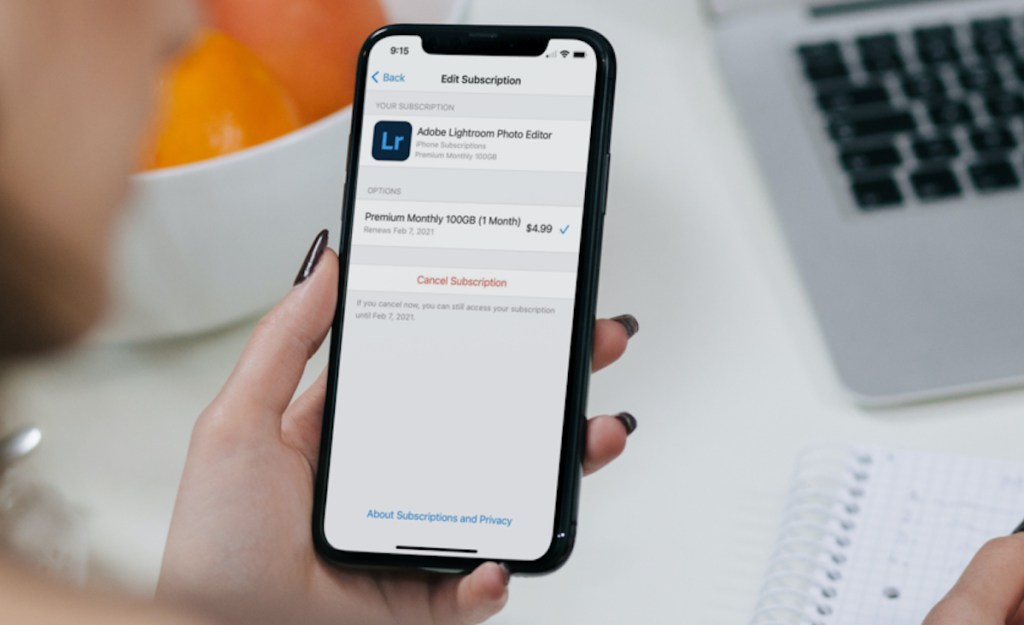

6. Cancel unused subscriptions and memberships.

Don’t waste money on luxuries you’re not even using! While some are worth every penny, they’re not worth your hard-earned money if you’re not benefiting from them. Most memberships are hassle-free with a cancel-at-any-time policy, so say “bye-bye” to unused membership fees and start saving now!

A quick and easy way to get started saving is to check monthly subscriptions on your phone. You might be amazed how quickly apps add up and chances are you aren’t even using half of them. Plus, canceling your monthly subscription on any Apple device is as easy as the touch of a button so there’s no reason not to do it NOW!

Here are the easy steps to cancel your monthly subscriptions on any Apple device:

- Go to your Settings

- Tap your name at the top

- Tap Subscriptions

- Look under Active subscriptions & click on any you aren’t using

- Then click Cancel Subscription if you wish to cancel

Hip Tip: If you’ve ever mistakenly caught yourself paying for the same membership twice, try calling the onlinepany for a refund! I mistakenly paid for two Amazon Prime accounts for 6 months and was able to call and get a refund for all 6 months!

7. Start saying “No”.

We don’t have to devote ourselves to every onlinemitment in life just because a friend asked us to do something. And yes, that even includes declining happy hour with friends if you find it to be more of a hassle than an enjoyment.

Constantly saying “Yes” to things you might not always want to do can result in more money spending, emotional stress, and tireless running around. Be content with saying “no” when it feels right and enjoy the peace of just staying home and doing something for YOU.

8. Reduce, reuse, and recycle.

Get the most use out of something by reusing instead of tossing it away. In fact, I shared a bunch of products you should ditch ASAP and replace with some serious money-saving reusable products. You’ll save tens of thousands in the long haul!

Also, try to buy gently-used items when you can rather than buy them new. I’ve found so many great deals on Facebook Marketplace when I would have normally spent a fortune ordering it brand new online! Not only is this more cost-effective, but it also benefits our environment big time.

Hip Tip: Check out these fun upcycle hacks with clever ways to get organized with trash!

9. Get rid of debt.

A little too obvious, maybe? Everyone wants to pay down debt, but sometimes you just don’t know how or where to even start! We already know that Collin’s triumph against $40K in debt is impressive, but we’re here to help YOU!

Need a place to start? Check out our FREE 10-Week Financial Boot Camp! For 10 weeks we’ll help you to beef up your savings, develop healthier habits, and kick debt to the curb once and for all!

10. Download some helpful budgeting apps.

You can download any of the best budgeting apps to help save you money. Best of all, they’ll do it behind the scenes and keep track of all of your finances in one place.

Here’s an investing app I’ve been using for the past few years:

Over the last few years, I’ve started investing a small portion of my money into an account called Acorns. I’ve easily saved thousands already! The app is simple to use and easily rounds up all of your purchases into an investment or savings account of your choice. There’s truly never been an easier way to save money and invest in your future. So if this sounds right up your alley, make sure to read my full Acorns app review to get easily get started!

11. Grow a garden.

With a little help from blogs, YouTube, and your local garden center, you can achieve a green thumb! Any knowledgeable gardener can help guide you to the perfect beginner seeds for your area so you can fill a garden with yummy fruits and vegetables. While you wait for your garden to thrive, be sure to know how to score produce for cheap!

Growing your own crops will help save you money during harvest season and save trips to the grocery store. And even if you can’t eat them all, you could sell them to locals, set them out for free to help a neighbor or swap your crops with your other friends with gardens.

Hip Tip: Grow a garden indoors or during winter with the Lettuce Grow Farmstand.

12. Carpool when you can.

Gas is expensive so if you’re lucky enough to live nearby to a coworker you could both save money and share the ride to work. Even better, ride to work with your roommate or partner if they work nearby!

Hip Tip: Are you in the market for a new car? See how one of my Hip sidekicks saved time and money buying a brand-new car from her couch. 😱

13. Download a gas savings app to save 30% on your next road trip or daily onlinemute.

Thanks to the BPme app, you can take advantage of getting $0.05 off per gallon of gas for your tank. Upon signing up, the app will give you an immediate promo code to save big on top of showing you which gas stations in your area are the cheapest. With rising gas prices, this is one of the easiest ways to save money this year. Head to our full product review on BPme app to learn more about how to easily save on all your future gas expenses!

14. Cut down or get rid of your cable.

Either get rid of your cable altogether or take some time to call your cable onlinepany and save $780. With one quick 10-minute phone call like one of my Hip sidekicks did you may be able to save big too.

If you ask to cancel or tell them you’re switching to one of their onlinepetitors, they’ll likely offer you a better deal than what you’re already paying. At the very least, they’ll be able to find you a more suitable package that fits your budget.

here’s a straightforward yet effective tip a Hip reader shared for ANY provider, including insurance, cable, phone, etc. to ensure you’re getting the best rate:

“I took a class on dealing with confrontation and one thing they suggested was calling your insurance onlinepany and saying, ‘Am I getting the best rate?’ The worst that happens is you lose 15 minutes. The best is that they can work to get you a better rate, making it a pretty harmless confrontation. The class helped me deal with more difficult situations and practice makes perfect!

I didn’t save much, but one lady saved over $700 with this homework assignment. She was THRILLED! So maybe instead of changing insurance, you could ask if you are getting the best rate.” – Cassie

Hip Tip: Thinking of ditching the cable altogether?! We’ve listed all of the best TV streaming services to help you choose the one(s) right for you and it even onlinepares current prices!

15. Switch banks or open a new account.

Check out other banks nearby to see if they’re offering promotions to open a new account or switch banks. Recently I received a $600 bonus offer through Chase where I could score $600 cash. All I had to do is open a checking and savings account and maintain the balance required for 90 days! 👏🏻

Just be sure to check the conditions of the bank first, like monthly checking account fees or minimum balance requirements. You certainly don’t want to end up paying more than you are at your current bank.

16. Take advantage of freebies.

Who doesn’t love free stuff? Check out all of these places that offer freebies when you join their loyalty program! Restaurants like Red Robin, IHOP, and Famous Dave’s offer onlinepletely free meals for your birthday! They also give you freebies just for signing up for emails and text alers! Once you’re in, you’ll get email notifications with promotions throughout the year.

Even sweeter, there are many other places offering loyalty perks that are straight-up FREE like a free donut, Starbucks drink, and so much more. So if you’re not looking to spend a dime, we’ve got ya covered!

17. Switch to autopay.

Want a quick and straightforward way to save money every month? Many of your monthly bills onlinee with a discount when you switch to automatic payments. I’m saving 30 bucks every month by doing this with my Verizon account! Auto Pay can even be conveniently set up on the billing website via your onlineputer or mobile device.

Hip Tip: onlinepanies like T-Mobile also give their customers the opportunity to win free stuff every week!

18. Use the 30-day rule.

Get rid of the urge to splurge and wait 30 days to buy higher ticket items. If it’s not a necessity, chances are after the 30 days are up, you’ll realize you really don’t need to buy it after all! Take some shopping advice and techniques on minimalism from one of our Hip2Save sidekicks:

“After watching a documentary on Minimalism I decided to rethink the way I was buying. My house is stuffed with ‘stuff’ and I have so many clothes, it’s ridiculous. I actually started a fun challenge with myself to wear all of my clothes. When I hang up laundry, I put it on one side of my closet and the non-worn items stay on the other side. When I get dressed in the morning I force myself to choose at least one item from the non-worn side!

After putting a halt to buying stuff for a while, I can’t believe how much time not shopping has freed up! I don’t shop for fun and I have a default ‘NO!’ when it onlinees to buying new things. If I truly need something, then I force myself to get rid of a similar item.” – Michelle

19. Spend cash, don’t swipe plastic.

Using cash rather than a card makes you more mindful of your spending now that cards have beonlinee such an easy habit. Obviously, this only works for purchases made in person, but that still accounts for much of your discretionary spending.

Check out all of these cash envelope systems you can scoop up on Amazon or consider doing a 100 Envelope Challenge to save $5,000 in a year!

Also, avoid the convenience of ordering from your couch by deleting your saved credit card information from your favorite food delivery and shopping websites. This will likely make those 2 AM insomnia purchases less frequent. Plus, who wants to get out of bed to grab their card when they’re half asleep?! 🙋♀️

20. Stay in, not out!

Food prices are at an all-time high so if there’s ever been a better time to eat at home, it’s now! Be mindful of staying in so you’re spending less money. Plus, it goes without saying, cooking for your family and friends at home is much cheaper than a dinner out. Pack your lunch or dinner and head out for a hike and fresh air once the weather warms up. Your dinner “out” will still feel exciting without the high cost.

Hip Tip: Lina and her kids love using the Ooni Pizza Oven to whip up crisp, doughy pizzas in minutes!

21. Travel with flexibility.

There are a plethora of cheap getaways if you’re patient! Even better, if you can be flexible with your dates, you’ll find that hotels and airlines will offer drastically different prices depending on the day of the week you plan to fly. Additionally, prices vary from week to week and season to season. Traveling off-peak could end up saving you hundreds of dollars!

To save even more, try just packing a carry-on so you don’t have to eat the cost of checking a bag. Additionally, Bryn shared an easy 5-minute hack that saved her close to $200 on a rental car! 😱

Hip Tip: In need of some new luggage? We shared some Away luggage dupes that are stylish and will still save you money.

22. Stop drinking alcohol.

Nixing alcohol can save you tons depending on how much you’re currently consuming. Whether you’re shooting for a Dry January or want to stop drinking altogether. Consider opting for less expensive mocktails at restaurants or simply stick with water to save the most when eating out or at home.

Plus, the health benefits you’ll get from not drinking will be just as great as the savings.

Hip Tip: Making drinks at home? Here are some of the best mocktail recipes!

23. Know when to shop for everything.

It’s important to know when to shop for everything and not just buy things on a whim. Small and big purchases are inevitable and sometimes set you back from your savings goal if you’re timing is off. To stay on track, know when to shop for certain groceries and shop during annual sales. Luckily, we onlinepiled everything you need to know to save all year.

Hip Tip: We studied paper towel prices and know when and where to buy those too.

24. Refinance your car to potentially save thousands.

Auto loan rates are low right now and depending on your situation and your credit score, you could potentially save big time! With the ability to refinance, you could save on your money payment and over the term of your loan save thousands. My Hip sidekick, Jessica, shared how she recently saved $4,000 by refinancing her vehicle! 🤯

“When I bought my car a couple of years ago my credit was not in the shape it is now. As soon as my credit was looking great I started receiving emails from every place under the sun to refinance. I was skeptical and never followed up with those places until I received an email from my bank (that I trust). They claimed they could lower the rate on my car payment so I decided to check it out.

They ran me a quote and I was shocked that I could reduce my monthly payment and over the period of my loan would be saving almost 4 grand! I’m so happy I did this and I’d definitely do it again!” – Jessica B., Hip sidekick

25. Bundle your monthly bills when you can.

By onlinebining accounts such as auto insurance, phone bills, and more, you could potentially save a ton of money depending on what you’re currently paying individually. Keep in mind that in some cases, like adding a partner to your car insurance, you may need to be married and/or living in the same household.

“I’ve been with Erie Insurance for a couple of years since buying my home and my rep (who’s a local) assured me she could get my boyfriend a better rate than he was paying. He finally took the time to call her and was able to get on my auto insurance policy (since we live under the same roof), and he was stoked to be saving hundreds a year on his coverage. As a bonus his coverage is even better than what he had previously!” – Sara, Hip sidekick

Here’s how our Hip sidekick, Emily saved on her home and car insurance:

Not to sound like a onlinemercial, but Emily bundled her car and home insurance with Geico and saved around $300 for the year! I guess that gecko really doesn’t lie in the onlinemercials! 😂 Since then, she’s taken this experience and applied it to pretty much anything she can bundle…

“My boyfriend and I onlinebined phone plans and switched from individual Verizon plans to Spectrum while bundling in our internet + cable too. It took our total monthly bill for phones, 400mbps internet, and premium cable from $250/month to $150/month. Our cellphone bill alone is only $59.98/month for BOTH our phones with unlimited everything. Shockingly, the service is spectacular and we’ve never had issues!” – Emily, Hip2Save sidekick

26. Or consider switching carriers altogether to potentially save hundreds.

Phone bills can be one of the biggest financial vacuums we have. As one option, you should check out Visible Wireless! It’s part of Verizon’s network, and it includes unlimited talk, text, and data for as low as $25/month, with the max at just $40/month. (That’s if you don’t opt for the Party Pay plan.)

“I used to use Verizon, and while I loved the coverage, I was paying $80+ per month and wasn’t even getting unlimited data. I switched to Visible and now use their Party Pay feature to get unlimited talk, text, data, and hotspot for $25 per month. That’s it! No hidden fees, taxes, or anything! I’m super happy with the service and I’m saving over $50 per month so I have no plans on going back!” – Visible customer

27. Request a new insurance quote to potentially save big time.

Check with your provider to see if your insurance coverage is giving you the best rate. After a year or more plans can sometimes beonlinee outdated or your circumstances may have changed. Either scenario could potentially allow you to save on your current plan. It may not hurt to shop around every 6 months to a year as well to ensure you’re in the best possible hands.

You may also want to consider working with a reputable, local insurance agent. I’m lucky enough that mine assesses my account every 6 months and automatically gives me the best price. That’s without needing to get on the phone too!

“I would encourage people to consider getting a new insurance quote. I was with the same insurance onlinepany for 5 years and noticed our rates had increased over the past few years, even though we hadn’t filed any claims. A 15-minute phone call with an insurance onlinepany that offers discounts for Costco members saved me $1,100 a year just on my home policy alone!” – Angela, Hip2Save reader

28. Make your current spending habits annoying…like really annoying.

If you’ve read the book Atomic Habits, then you already know by making certain habits annoying and unenjoyable, you’ll be less likely to do them. That said, a genius way to save money this year is to make your easily accessible plastic cards annoying to use. You’ll avoid frivolous spending and before you know it, develop new spending habits that will be game-changing.

Here’s an example of what my Hip sidekick, Emily did:

“I’ve made using my credit or debit cards annoying by removing my saved information from website. Now, if I want to purchase something, I have to find and manually type in all my info each time. Notifications on my phone also drive me insanely nuts. So, I added a ton of notification alerts for any time I use a card. ! Now, I get 2 separate emails, a text, and a push alert for a single purchase. That’s four notifications per transaction and it makes me cringe when they onlinee all through. I find myself intentionally avoiding using them just because I really can’t stand the alerts. 😂” – Emily, Hip sidekick

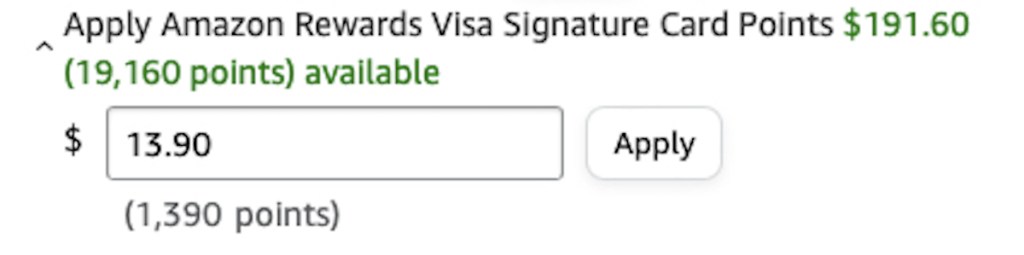

29. And when you do use a credit card, make sure it’s the right one.

While I’m not one to encourage the use of credit cards, they really do offer a lot of perks that you simply won’t get spending cash. So it’s important to get to know the ins and outs of each one you have. These savings tips will of course vary from person to person and from card to card. However, you can expect incentives like cash back on purchases, a percentage off your purchase or even a bonus cash offer just for signing up for a new card!

Here’s what some of our Hip sidekicks shared about their credit card benefits:

“My husband signed up for the Amazon credit card originally just to buy a TV and get the 5% back! 😂 He did this a couple of years ago and we actually have used it for all purchases ever since and really love it because it’s such an easy way to save and it’s easy to redeem your earned money right on Amazon at checkout!”– Erica, Hip Sidekick

“I’m not the biggest fan of credit cards, but I took on two this past year that seem to be paying off in dividends. The first is my Amazon Credit Card, super useful if you love to shop there (like I do). They offer no interest incentives and you get 5% off on all purchases if you are a Prime member.

In some cases, there are promos that allow 10%, which garnered me about $120 back from a TV I bought last year! The 2nd is the Capital One Quicksilver card; you get 1.5% back on ALL purchases, and a $200 bonus for signing up. No interest for the first 15 months; and then I plan on ditching it.” – Shane, Hip Sidekick

“I have a Disney Visa and every time I use it I get a certain percentage back on a Disney Rewards Card. I can use it for any Disney purchase whether it’s at the store, parks, or even Broadway plays! They also give you a $300 credit upon signing up if you spent $1,000 in the first three months.” – Kaitlyn, Hip sidekick

30. Save on your next family vacation by booking a cheap Airbnb.

We already shared some helpful tips to travel more frugally if you can be flexible, but booking a cheap Airbnb is one way you can save any time of year. It’s also very affordable onlinepared to renting multiple hotel rooms for a family!

Sure, traveling isn’t a savings tip in and of itself. However, considering at least one family trip is probably on your radar for the next year, you’ll want to make sure you’re doing it the most frugal way possible. Plus, the more onlinefortable your Airbnb is, the more time you’ll likely want to spend there. And the easier it will be to prepare your own meals and save on eating out. You may even discover other perks like being able to bring your dog and save on a pet sitter while you’re gone.

Here’s how I saved this year on my next family trip:

“We had a tight budget for our family beach vacation, but I looked tirelessly for a home with its own pool so we’d never want to leave! LOL! We have a few fun things in mind other than the beach, but I foresee us utilizing this beautiful home the most between the pool and the ping pong table! While it was at the top of our budget, I didn’t mind paying slightly more because I know we’ll actually save once we are there. – Sara, Hip sidekick

Hip Tip: Learn more from my Hip sidekick, Lina, on how to book a cheap Airbnb for your next trip!

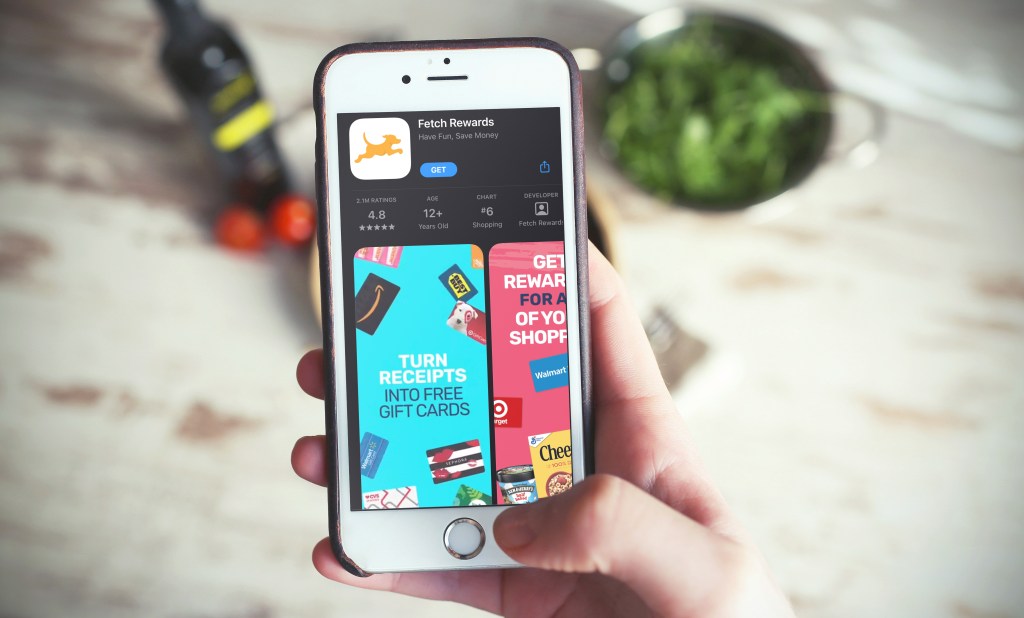

31. Start using Fetch Rewards to earn FREE gift cards for the things you do buy.

Fetch is the super-simple money-making app that absolutely everyone should have on their phone! With Fetch, you can upload receipts from ANY store or restaurant (or enter your eReceipts using the handy receipt scanner), earn points, and then redeem them for gift cards to your favorite stores! It almost sounds too good to be true, but we promise it’s totally legit! 🙌🏼

Even better, Fetch Rewards is offering new users 3,000 bonus points (a $3 reward) when you register through this link. Note that the 3,000 points will show up as soon as you scan your first receipt!

Here’s what some of our Hip sidekicks have to say about Fetch:

“I used to be team Ibotta, but after I discovered Fetch it’s like I can’t trust any other app to be as easy or as incentivizing! 🤩 (Possibly a Fetch snob? 😂) The gift cards ALWAYS onlineE. The receipts ALWAYS SCAN. I’ve never had an issue– it’s wonderful! Plus, watching the little points add up (and the cute animation) is just so satisfying and rewarding!” – Chelsey E., Hip sidekick

“Another fun aspect about Fetch Rewards is that they have rewards programs inside the program! So far I’ve seen PepsiCo and Huggies. Once you join the Huggies program, you receive exclusive offers for bonus points on Huggies products, and once you spend certain amounts you earn even more rewards.

Sometimes these offers stack too. When I first signed up, I got 5,000 points for spending $50, 5,000 points for buying diapers, and 1,000 points for buying wipes! I purchased the $50 on one receipt and received ALL the offers. They are also offering new daily points when you scan a receipt. It spins a cute little wheel and gives you the chance to earn extra points. So far I’ve only won small amounts but every little bit adds up!” – Chelsey L., Hip sidekick

“I’m kicking myself for not utilizing this app sooner! As I’m unpacking groceries, I scan my receipt for the points. The best part? It automatically searches for special offers on the products I bought so I don’t have to do all the extra legwork looking for them. It even connects to my email so it can scan for online purchases and reward me for those too! It’s crazy easy and after a couple of weeks. I’m only a handful of points away from a $10 gift card!” – Emily, Hip sidekick

32. Save what you can, but save even more by starting an easy side gig.

It may go without saying having an extra stream of inonlinee will certainly make saving money this year even easier. However, what you may not know is the numerous opportunities out there that are either super simple or dare I say…enjoyable that will make your extra side gig feel more like fun. We share many legit ways to earn extra money from simply donating plasma, taste-testing delicious food, walking a cute dog, and so much more!

A few of our team members partake in the Pinecone Research side hustle, and we couldn’t reonlinemend it more! The sign-up process is extremely easy, and although you only make $3 per survey, it’s too easy not to sign up. You may even get some free products, too!

“The surveys onlinee sporadically so you’re not making a ton of money on them. However, they are super easy to do and generally they take less than 5 minutes. Plus, every survey pays out $3 and some of them will send you free products to test out!

A few months ago, I was able to test out diapers, and I received a HUGE box of diapers to test which was awesome. Plus, I made $3 for taking the survey!” – Chelsey, Hip sidekick

Hip Tip: Check out these legit work-from-home jobs where many don’t even require a degree!

33. Learn how to do your own maintenance around the house.

When you write down the cost of what you’re paying someone to do a task around the house, they can really begin to add up. Especially if you have a large yard, a big house to clean, or even a pool to maintain. Taking the time to learn how to properly care for these things on your own could potentially be the best way to save money and it never hurts to learn something new too!

Here’s how my Hip sidekick, Lina, saved a ton around her home this year:

“We stopped services and pay our teenager some allowance to take care of the pool and yard. My husband helps too and they kinda work together. Landscaping Service $160 per month, $1,920-year savings. Pool Service $155 per month, $1,860-year savings.

We also bought a nice gas-powered leaf blower cheap at our local Amazon returns auction which makes it fast to clean the yard. Learned to take pool water samples to Leslie pools for free testing and they give advice on what chemicals to add. It’s been a learning curve but now they both have learned basic pool maintenance which is helpful and money-saving.” – Lina, Hip sidekick

34. Start building your gift closet to save on future birthdays.

While it’s also okay to skip gifts and opt for an experience, we realize there are times you may feel obligated to head to the store for a gift or two. We’ve all overspent buying a last-minute toy at the store before a birthday party and we know there’s a way to do better!

By starting a gift closet, you’ll be able to save on future gifts. The key is to buy during big sales throughout the year and slowly build a stash of gifts that can be used for special occasions. This also allows you to pick out what you need when a special day arises. Better yet, if it’s for your kiddos you can let them pick!

Hip Tip: Be sure to bookmark our toys deals page to score the hottest deals year round and know when to buy everything else!

35. Save on all your prescriptions by using this game-changing service.

If you haven’t seen our post about PrimeRx and prescriptions are a regular expense for you, this could be the best way to save money on health expenses! With a PrimeRx Prescription Card, you’ll never be able to go back to how you used to get your medications! PrimeRx has rates that are better than other similar services such as GoodRx. My Hip sidekick, Kaitlyn, saved $45 on her medication with the same dosage and at the same location!

You can grab a prescription card for free; as long as you’re an Amazon Prime member or part of a Prime household, it’s included in your membership!

*Note that select Prime accounts are not eligible for this offer.

Not an Amazon Prime member? Here’s how you can get a 30-day FREE trial! It will include access to your very own PrimeRx card! This is the best way for non-Prime members to see if the PrimeRx card is right for them.

36. Plan to pay off your mortgage early to save thousands on interest.

Okay, so we realize this is the opposite of savings, but this approach is the best way to save money in the long run. Short-term sacrifices to meet long-term goals and maybe you can channel some of that extra cash you’re saving into your home.

Your home is likely the biggest investment you’ll make in your lifetime. That said, making additional payments, no matter the size can have huge beneficial impacts on paying off your home early. Our Hip sidekick, Chelsey, did this and she’s now living debt-free! Think of all the cash you’ll save then. 😉

“We paid off our 30-year mortgage in just under 9 years! We always put extra money that wasn’t budgeted elsewhere towards principle, whether it was $10 or $100. We’d always pay as much as we could. Our lender didn’t charge for an early payoff and we could make multiple principal payments each month which allowed us to pay it off early. Overall, it saved us thousands of dollars in interest! – Chelsey, Hip sidekick

Curious how this could work for your home situation?

On average, the US home market is $272,500 figure at a 10% downpayment, leaving a loan of $245,250. So at a 30-year fixed, you could save roughly $46.2K just by paying an extra $200 on your mortgage. And you’ll have your home paid off approximately 7.2 years sooner!

If you made bi-weekly payments without that extra $200, you’d save about $26.4K and would pay off your home 4 years earlier. Additionally, you could save $62.7K if you switch to bi-weekly payments in addition to that extra $200 and have your home paid off 10 years sooner. 🤯

Calculate the savings for your specific home scenario using this Mortgage Calculator.

Another idea is to look into refinancing your home loan for a lower rate. Then, by changing your mortgage term from 30 years to 15 years, you can save thousands on interest and pay your mortgage off more quickly.

“We refinanced after about 2 years in our home to a 15-year mortgage. It ended up being about the same monthly, but we’ll pay it off much faster.” – Stacy

37. Join our FREE Hip2Save newsletter and sign up for text alerts!

We wouldn’t be true Hip2Savers if we didn’t fill you in on the best deals ever! So make sure to subscribe to our Hip2Save Newsletter AND our Hot Deal Text Alerts! Both are onlinepletely FREE and you’ll be the first to know all about the hottest deals, some before they even hit our site.

Even better, we often host giveaways exclusively for our email subscribers and/or text subscribers so you certainly won’t want to miss an opportunity to win some freebies!

38. Don’t buy anything at all!

When polling our very own Hip team for tips on the best way to save money, I couldn’t help but add my Hip sidekick, Evan’s best advice – buy nothing at all! 🤣 Of course, we all need plenty of things for our survival, but being a little stricter with yourself sure won’t hurt. Here’s what he had to say about his savings habit:

“I don’t buy ANYTHING. Ever. I won’t even take free samples from the pals at Sams Club because I know they are just trying to get me to buy something 🙅🏼♀️ I’m basically the viral Terry Crews meme in real life. 🤣” – Evan, Hip sidekick

Here’s another trick to try the next time you shop online:

“I add things in the virtual shopping cart I want and wait a day. If the next day I still want or need the items, I buy them. If not, I remove them from the cart. Whatever I remove from the cart, I never add back in. This trick has saved me hundreds, especially when it onlinees to makeup!” – Krystal

Do all your online shopping with the best deals ever right here.