Experian FREE Credit Report & Monitoring | No Strings Attached or Credit Card Required

Did you know that you can monitor your credit for free?

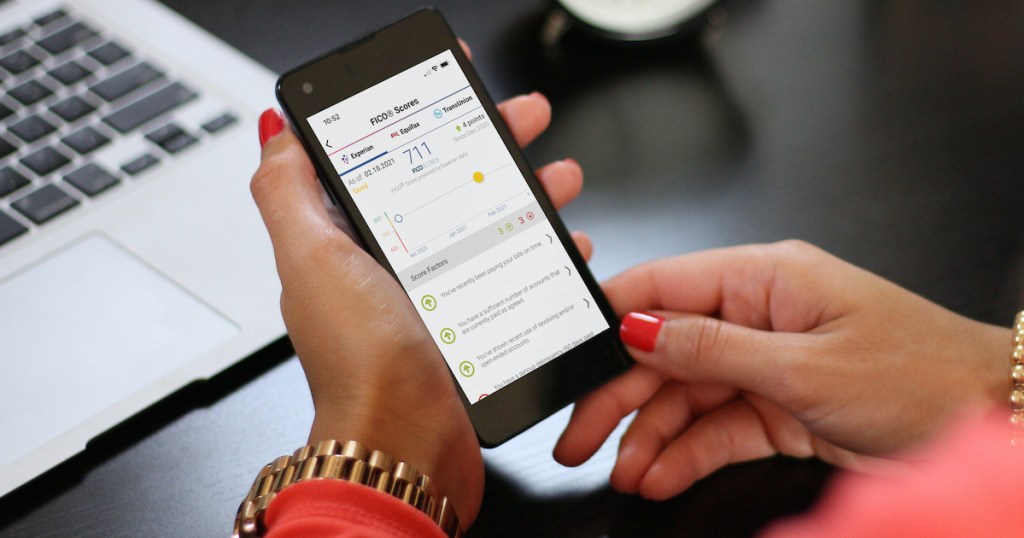

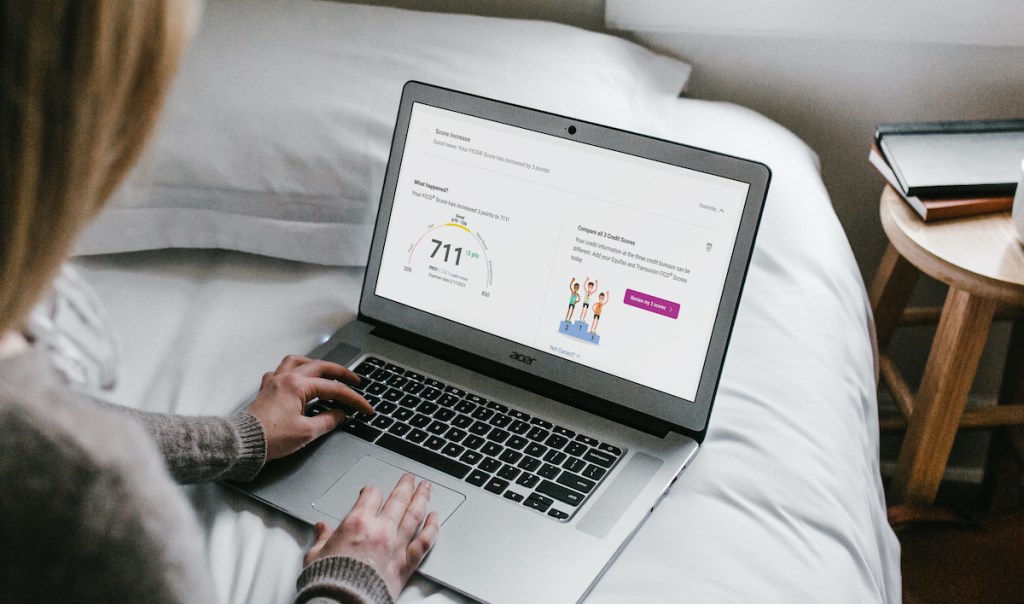

Head on over to Experian where they are offering a FREE Credit Report – no purchase or credit card required! Plus, with this Experian offer, you’ll also get access to a free updated credit report every 30 days upon sign in.

You’ll also receive free credit monitoring with alert notifications when important changes occur which is a great way to prevent fraud! In the unfortunate event that you do experience fraudulent activity, you can also place and lift a credit freeze on your account. Plus, you can dispute and track any inaccuracies online – all for FREE!

Experian also offers helpful tips on what can help or hurt your credit such as opening too many accounts, closing accounts early, not paying your balances in full, and more.

Why check your credit report?

Checking your credit report allows you to easily stay up-to-date with your credit history. Even better, Experian makes it super easy to view exactly what is on your credit report with just a glance! It’ll show what loans and credit cards you have open as well as any inquiries into your credit. The credit report also shows if you have any negative items like collections or bankruptcies.

You’ll be able to make better financial decisions, detect signs of identity theft earlier, and understand how your financial standing might be perceived by a lender.

Higher credit scores often help lower your interest rates on home and car loans, so keeping an eye on your credit can help you know when the best time is to apply or even what you need to do to raise your credit score. Lenders can see whether you’ve made your payments on time or if you have any outstanding debts which can also affect your chances of not only receiving a loan but also dealing with varying interest rates.