Have a Hard Time Saving Money? You NEED This Budgeting App!

“Saving money is so simple!” … said no one ever.

I’d like to think I’ve always been financially responsible. I know how to budget, I paid off my student loans six years early, I have a great credit score, and I jump at any opportunity to learn about money management. But if I’m being honest, actually getting money into my savings account is not an easy task for me.

And I don’t know why! I see my paycheck clear, I pay my expenses, and I should just be transferring the leftover inonlinee into my savings. Am I worried I won’t have enough left in my checking account? Or am I really that lazy to set up the transfer? I think it’s a mix of both, maybe with a higher focus on the latter.

That’s why Digit has beonlinee a must-have for my smartphone screen. Let me tell you about this glorious app.

What is Digit?

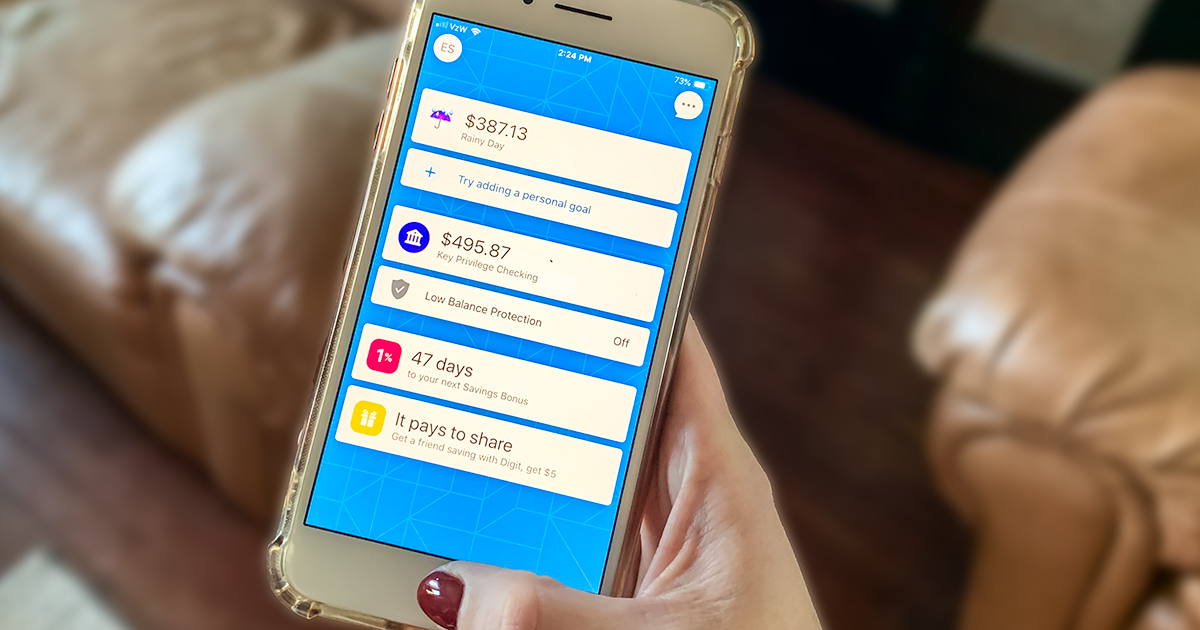

The Digit app connects to your bank account to move small amounts of money from your checking account into a Digit savings account on a daily basis. By transferring smaller amounts, users are less likely to notice the money leaving their checking account, but the accrual in savings is huge!

I have never noticed the money leaving my account yet since downloading this app back in February, and I’ve already managed to save nearly $2,200 with this app.

Going from having no sense of savings to socking away $2,174 in savings over the course of a year is a HUGE aconlineplishment for me. And I wouldn’t have been able to do it without this helpful little app! There are some key features that make this budgeting app pretty much perfect:

1. Set up is simple.

Sign up and connect your bank account so that Digit can pull small amounts from your checking into a savings account in the app. With smart algorithms, it will also check for uponlineing expenses, checking balance limits, and previous expenditures so that it won’t transfer more than you can afford. Transferring money for your Digit savings to your bank checking account happens in the click of a few buttons (and without any fees).

2. Transfers are automated.

Set it and forget it! The daily transfers are automated so you don’t even have to think about moving the money around. You can also sign into the app to see pending transfers, set a max for the daily transfer amount, or pause saving for more control.

3. It keeps you updated with your balance and milestones.

Curious about what’s happening in your banking account? Digit will send you a daily text to let you know your current balance, as well as recent transaction amounts (if you’re wondering what caused the balance to change). By texting back the word “Recent”, you’ll be updated with more information about each transaction — all without having to log into your banking app!

4. You’re protected from overdrafts.

If you’re ever worried about your checking account dipping too low, you can set up your Digit savings as a backup to fund your checking account if it’s under a specific dollar amount. Yay for avoiding overdraft fees from your banks! Oh, and if you do happen to have an overdraft from not having enough in your checking account, Digit will foot the fee bill.

5. The app rewards your good saving habits with bonuses!

While keeping money in your Digit savings account won’t yield you any interest from the bank, the app does offer savings bonuses. Every three months, you’ll receive 1% of the average balance in your Digit savings account. That could potentially be more than what your bank offers!

And this is just the tip of the iceberg! There are even more features you can use from Digit that I have yet to take advantage of, such as paying credit card bills directly from the app, creating multiple savings accounts for specific expenses, and Apple Watch integration.

I will say though, this app does eventually cost some money. It used to be free for the first 100 days, and then $2.99 per month after the trial period. Unfortunately, the onlinepany recently cut down that trial period to a mere 15 days, which is a huge bummer! To many, the monthly fee may be a deal-breaker (I get it because paying money to save money is pretty counter-intuitive). But for me personally, I think it’s 100% worth it as I would have never been able to save $2,200 on my own.

All in all, I’m learning healthy money-saving habits, so I can eventually meet my financial goals without the assistance of external apps. But until I work at them entirely on my own, I’m so excited to watch my savings grow thanks to Digit!