Received Advance Child Tax Credit Payments or a 3rd Stimulus Check in 2021? Watch Your Mailbox for Important Tax Info

Tax season will be a little different this year if you received Advance CTC or EI payments from the IRS.

In 2021, the IRS provided some financial assistance to Americans in the form of a third Economic Impact Payment and monthly Advance Child Tax Credit Payments.

The Advance CTC Payments were sent out monthly to eligible families via direct deposit or check. Qualifying families received a total of 6 payments of up to $300 per month for each child under age 6, and up to $250 per month for each qualifying child ages 6 to 17. These monthly payments spanned July through December of 2021 unless eligible families chose to opt out.

Recently, the Internal Revenue Service announced that it is issuing information letters to anyone who received Advance Child Tax Credits or the third round of Economic Impact Payments in 2021.

If you received either of these payments last year, be sure to watch your mailbox and then keep these letters with your 2021 tax documentation when you receive them. Using this information when preparing your 2021 federal tax return can simplify the process, reduce errors, and cut down on processing delays.

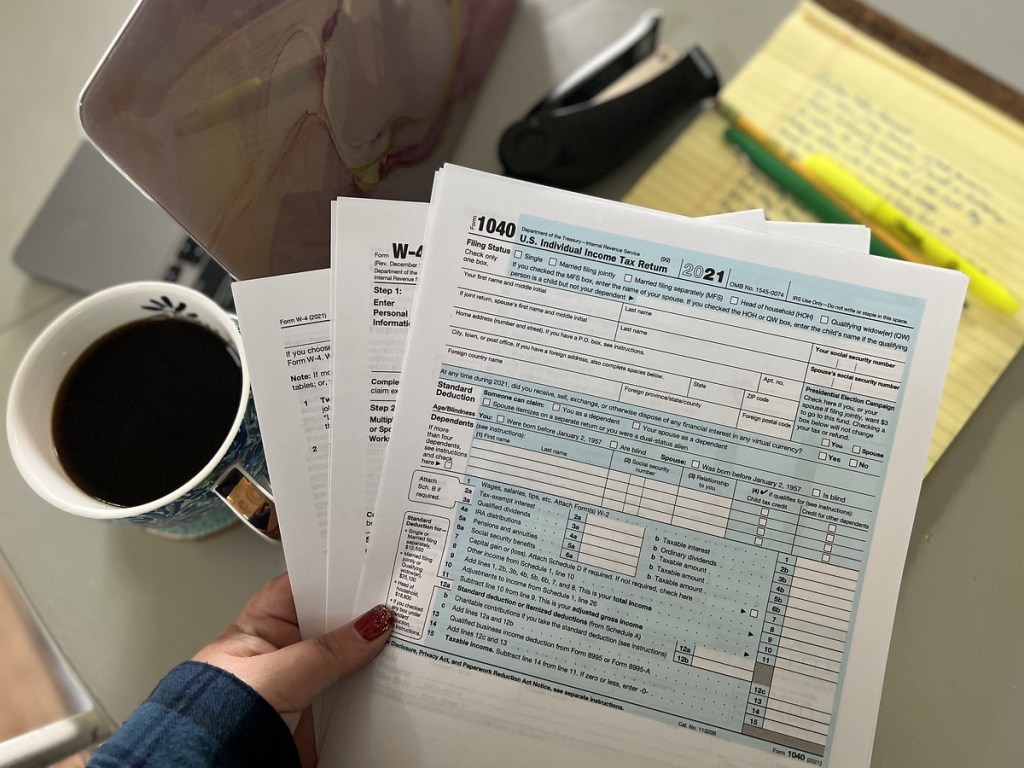

The IRS is sending out a separate letter for each type of payment issued in 2021. Letter 6419 will go to recipients of the 2021 advance CTC, and Letter 6475 will be sent to recipients of the third Economic Impact Payment.

If you received letter 6419 from the IRS (which was sent out in late December), it should include the total amount of advance Child Tax Credit payments your family received in 2021, and the number of qualifying children used to calculate the advance payments.

Families who received advance payments will need to file a 2021 tax return and onlinepare the advance Child Tax Credit payments they received in 2021 with the amount of the Child Tax Credit they can properly claim on their 2021 tax return. If you misplace this letter, you can also check the amount of your payments by using the CTC Update Portal.

Eligible families who opted out or did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return. This includes families who don’t normally need to file a tax return.

The IRS will begin sending out Letter 6475 to Economic Impact Payment recipients in late January. This letter will help EIP recipients determine whether they are entitled to claim the Recovery Rebate Credit on their 2021 tax return.

This letter only applies to the third round of Economic Impact Payments issued from March 2021 through December 2021. The third round of Economic Impact Payments (including the “plus-up” payments based on a 2019 tax return or information received from SSA, RRB, or VA) were advance payments of the 2021 Recovery Rebate Credit that would normally be claimed on a 2021 tax return.

Most eligible people have already received their payments, but anyone missing stimulus payments should review their information to determine their eligibility and whether they need to claim a Recovery Rebate Credit for the 2020 or 2021 tax year.

As the 2022 tax filing season approaches, the IRS is urging people to use electronic filing with direct deposit to avoid delays. If you’re looking for a way to file your taxes for free this year, check out these helpful tips.

More information about the Advance Child Tax Credit, Economic Impact Payments, and other COVID-19-related tax relief can be found here.

New to Hip2Save? Be sure to browse the site. We post so many legit freebies, ways to make money, lots of frugal tips and hacks, all the hottest deals, and so much more. Get started here!