Hip Team Members are Loving This Debit Card for Kids–Here’s Why!

Skip traditional banks and teach your kiddos solid financial habits with the Greenlight debit card for kids.

Are your kids ready to learn about real-life finances?

Giving them a debit card when they’re younger can be a practical, effective way to teach them all about the value of a dollar and let them practice a little independence.

Unfortunately, there are often a lot of hoops you have to jump through when trying to get your child a debit card with a traditional bank. You also may not be totally in love with the idea of giving your teen access to cash before they’ve learned the basics of budgeting and finance.

If you’re in the market for a safe & easy-to-use debit card for kids with a ton of neat perks and features, we have several Hip team members who use the Greenlight card and absolutely love it!

And for a limited time, you can get a FREE $10 deposit once you onlineplete your free trial!

Head over to Greenlight

Enter your mobile number & click “Get Started”

Enter code promo10 (case-sensitive)

Finish filling out your information & you’re all set!

The $10 deposit will be applied automatically after the 30-day free trial ends and your paid subscription begins.

Note: You will not receive a $10 deposit if you do not begin the paid subscription.

All kids can get a debit card with Greenlight!

One of the most unique aspects of Greenlight debit cards is that there’s no age limit. It’s truly a debit card that allows you to start teaching them practical financial skills at any stage. 🙌 You can apply for a debit card as soon as you want to start allowing your kids to use them.

The cost per month to maintain the card is only $4.99–the same, if not cheaper, than many other financial institutions.

And right now, Greenlight is offering your first month free + free cancellation any time!

While kids can use the Greenlight debit card, the parents are still in control.

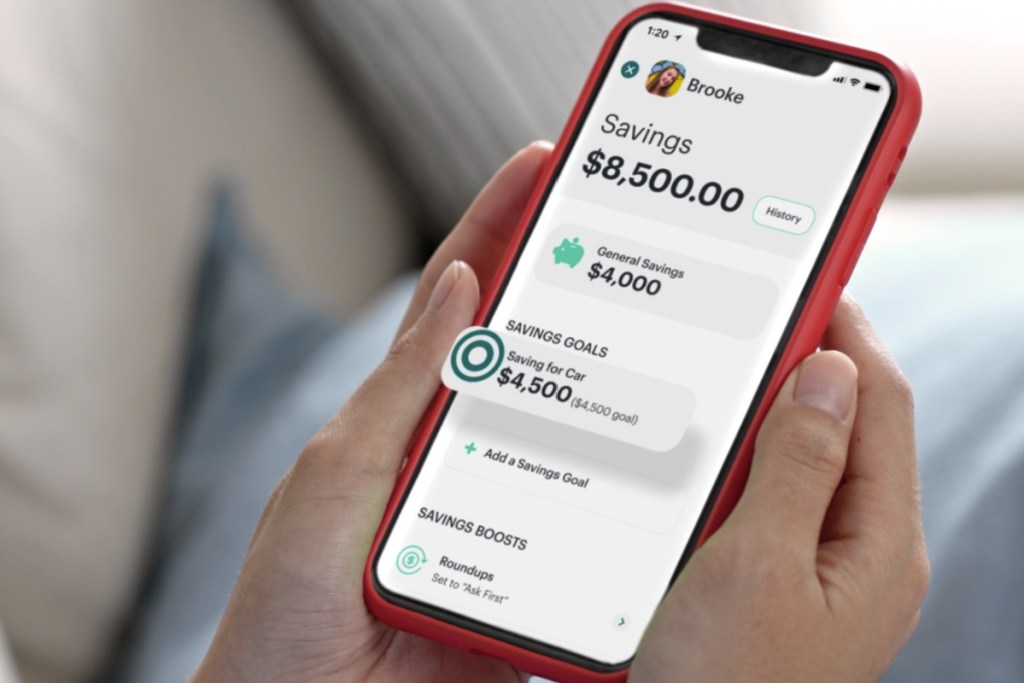

Once you receive your Greenlight debit card, you and your child can both download the same Greenlight app, but you’ll have access to different features. Parents can easily transfer cash into their kid’s Greenlight account via the app, so they’ll be in charge of how much their child has access to.

You can keep it simple by transferring a set amount and calling it a day, OR you can take advantage of the neat features that Greenlight offers!

Transferring from your existing bank account is also really easy with Greenlight.

Parents can transfer money into their child’s account from their own checking account at any bank instead of having to create their own just for Greenlight transfers.

My Hip teammate, Melinda, recently started using Greenlight and said the flexibility was one of her favorite perks.

“We want our kids to have an account and get used to having a debit card. When looking at other banks and trying to decide what sort of debit card to get our daughter, we realized we needed a bank account wherever we got her a debit card. For example, if we wanted to get her a Chase card, we needed to have a Chase account. With Greenlight, you can link your existing bank account to the card. So our daughter’s Greenlight debit card is linking to our Charles Schwabb checking/savings account, which we like.” – Melinda

Transferring between accounts at different banks can be difficult and often loaded with fees, so Greenlight is perfect for parents looking to avoid those unnecessary steps.

Here are some other things that set Greenlight apart from a traditional debit card:

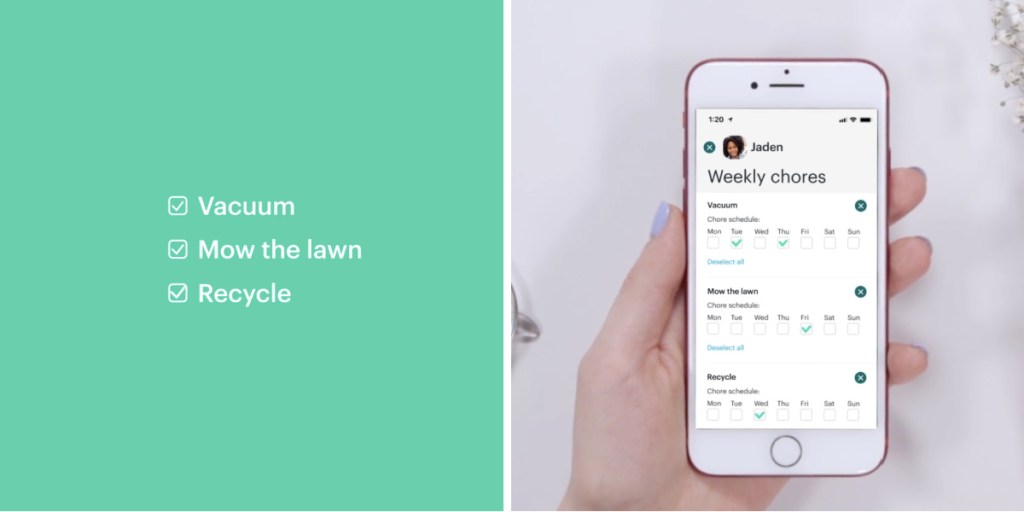

- The ability to create chore lists. Parents can delay their kid’s ability to access the money until they onlineplete their chore list, rewarding them for onlinepleting all the tasks.

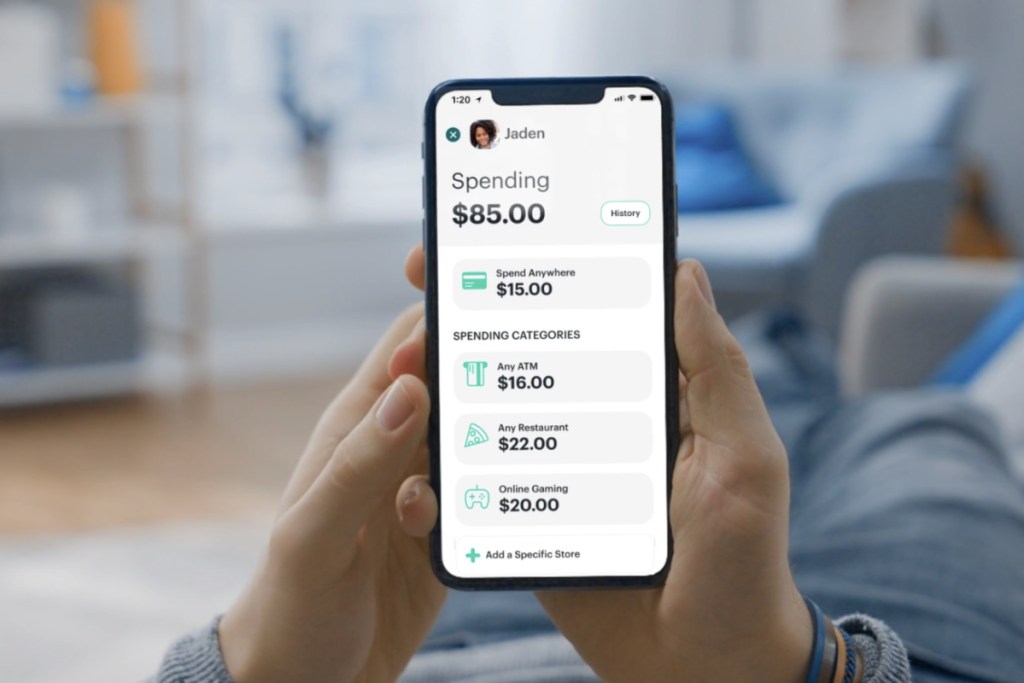

- Real-time spending alerts. Parents will always know what, when, where, and how much their kids are spending.

- The ability to switch off the card. If the Greenlight card is lost or stolen, freezing it is as easy as clicking a button.

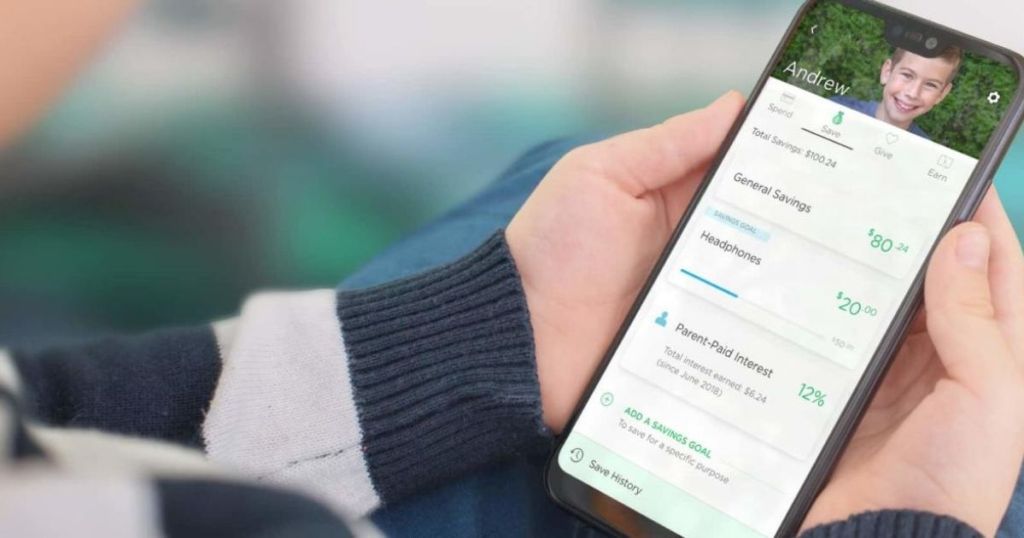

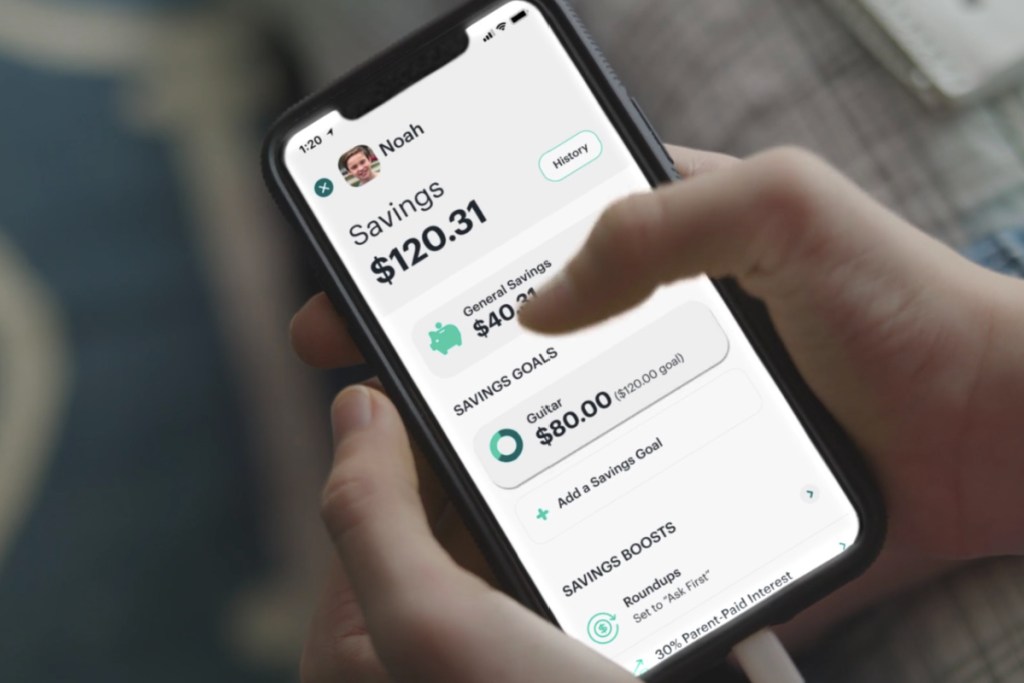

- The Round-Up program. Kids can save while they spend! Each time they make a purchase, Greenlight will round it to the nearest dollar and put that toward their savings.

- Parent-paid savings interest. Want to teach your kids the benefits of onlinepound growth? You can opt to set a parent-paid interest percentage for their savings accounts!

My Hip teammate, Bryn, has also been using the Greenlight card for several years and finds it super helpful!

Here are a few reasons she loves it:

“We quickly discovered how awesome Greenlight is especially for families with tweens. First, the Greenlight app is super easy to use and allows you to easily and instantly move money from your Parent Wallet into your kiddo’s wallet (I have used this feature when my kids have been with a friend’s family and end up stopping somewhere to eat and quickly need some $ to cover their meal). I love that because it’s a debit card and it has a Mastercard logo so it is accepted anywhere Mastercard is accepted. Kiddos cannot spend any money that they do not actually have in their Greenlight wallet.

Parents also have the ability to instantly turn the card off via the app, automatically transfer allowance payments, manage chores, and (my favorite feature) receive alerts whenever the card is used! I love this feature as it is super helpful to get real-time alerts about where my kiddo is spending money AND how much they just spent.”

She also noted, “we do pay a monthly fee of $4.99 but this fee is well worth it in my opinion, and keep in mind that it includes debit cards for up to five (5) kids so both of my boys have their own Greenlight card.”

A lot of folks are turned off by monthly fees, but seeing as most banks charge the same monthly fee per account, you’re still getting the best deal with Greenlight. 🙌

Another great perk that onlinees with getting a Greenlight debit card for kids is zero risk of NSF fees! Even if you set up a guardianship account with your child at a traditional bank, they’re very limited in what they can do and may still get hit with overdraft fees if they aren’t careful. These can be outrageously high and often onlinepound to put overdrawn accounts severely in the negative.😱

My Hip teammate, Stacy, said it best:

“I could totally add them on to my credit union account and have the perk of easy transfers. They even have bank cards for kids, but they don’t have a built-in system for chores and they don’t have any safeguards to keep the kids from getting NSF fees.”

And speaking of safeguards, here are the ways that Greenlight keeps parents protected when getting a debit card for kids.

First, like almost all banks, your Greenlight account is FDIC-insured for up to $250,000.

Second, there are certain debit card transactions that your kids will not be able to onlineplete. Per the Greenlight website, these include:

- Wires or money orders

- Security brokers or deals

- Dating/escort services

- Massage parlors

- Lotteries

- Online casinos or online gambling

- Horse racing and dog racing

- Non-sport internet gaming

- Cashback at the point of sale

It’s a pretty onlineprehensive list, and it still allows your kids to use their debit card for normal, everyday purchases without the risk of them using it for something that could get them in trouble.

If you want to take things a step further, you can also teach your kids about investing!

Signing up for Greenlight Max lets you start teaching your kids about investing–starting with only $1!

And while signing up for Greenlight Max will increase your monthly payment from $4.99 to $9.98, you aren’t on the hook for any trade fees, which are often even more than the difference between the regular and Max Greenlight accounts.