Collin’s Story: Me Vs. $40K of Credit Card Debt, and How I Dug Myself Out

Let’s talk about finances. Yes, like really open up & have an honest conversation!

I think I felt some of you wince as you read that sentence. It is just so unonlinefortable (or cringy as my kids would say!) to bring up money in any conversation. I mean, most people I know would rather talk about their sex life than chat about their inonlinee or expenses.

But not talking about our finances can leave us feeling alone and alienated, especially when struggling to stay afloat. Did you know that the U.S. credit card debt figure is at an all-time high of $870 million?! So if you’re having a hard time with debt, you’re certainly not alone.

That’s why we’re starting a new series on Hip2Save to bring our money struggles to light, no matter how unonlinefortable it may feel at first.

As some of you may know, I have my fair share of stories to tell that apply to my issues with spending. But after years and years of work and teaching myself new habits, I’ve been able to turn them around for the better (I mean, I did start a frugal living website after all 😂).

Today, I’m starting with how my money troubles all began. Buckle up, because we’re in for a rocky rollercoaster ride.

Growing up, I struggled in school to fit in.

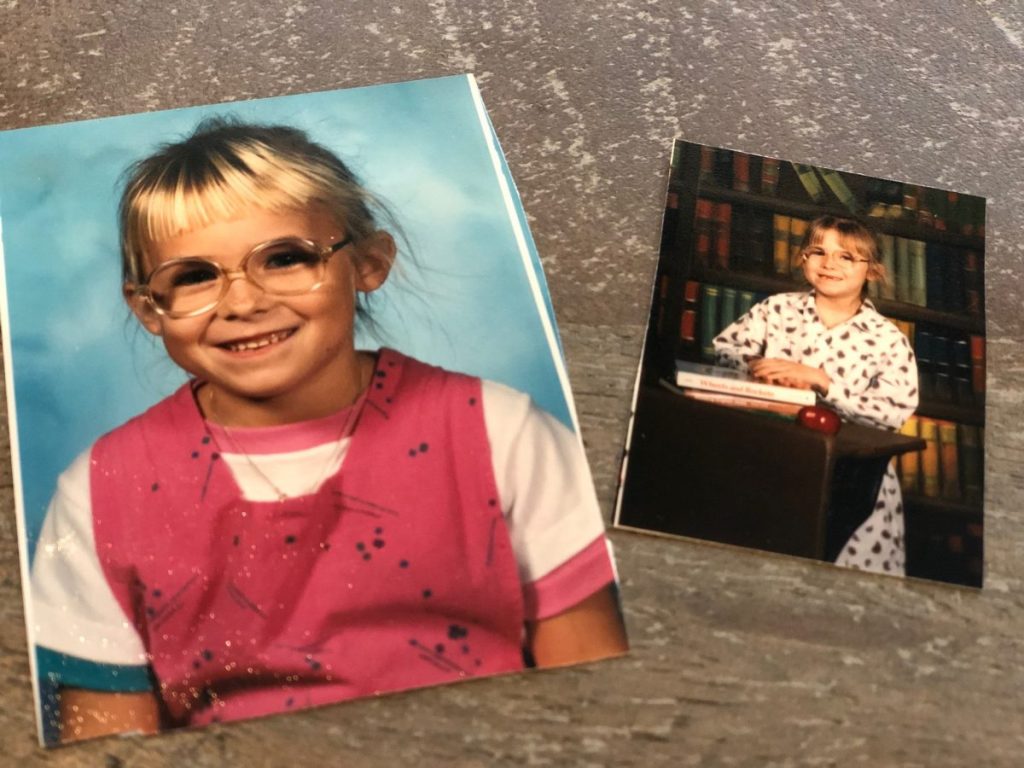

One of my most vivid memories of elementary school is the day I literally tried to run away from school. Every day, my sisters and I walked to school together and this particular day was no different. However, as soon as we arrived at school, I had the horrible realization that I had left my glasses at home.

Clearly, this was not a big deal in terms of my vision as I was able to walk to school without any issues but it was a HUGE deal for me on a personal level as these glasses had beonlinee my entire identity. Without my glasses (and also my hair being pulled into a ponytail), there was no way I was going to face that classroom of first graders. Side note – my older sister was able to contact my mom who graciously dropped off my glasses so I could go on with my day.

I still have that one day ingrained in my memory. Looking back, it seems like such a little thing, but knowing I still remember that day so clearly makes me realize that it was much more then forgetting my glasses. It was the story of a little girl who didn’t feel onlinefortable in her skin, who felt out of place, and who could hide it all with her magical glasses. Those glasses were her safety net.

I also learned early on that I had a learning disability and had to work that much harder to keep up with my peers. Homework and tests were a constant struggle and remained this way my entire school career. Each class, each math problem, each homework assignment built up doubt inside of me.

At 10 years old, I witnessed my parents divorce and my dad move all the way across the country. A few years after that, I moved with my mom and sisters from Houston, TX to Boise, ID. We moved to Boise not knowing a soul. I think for my mom it was a way for her to begin again and start a fresh, new life. I am forever grateful for that move. Although at the time, that wasn’t the case.

As a teen, my self-doubt led to low self-esteem, which led to self-medicating with drugs in an attempt to escape my problems. I almost didn’t graduate high school.

Then at 19 years old, I got pregnant.

In case it’s not clear, it was not a planned pregnancy. As I watched all my friends apply to colleges and shop for their dorm rooms, I was filling out a baby registry and stocking up on diapers… oh and watching endless hours of A Baby Story on TLC. That show and eating bowls of Kraft mac & cheese were my sanctuary.

I also began to start stressing about the financial hardships that would inevitably start popping up down the road. As many of you already know, having a baby is expensive, especially when you don’t know the first thing about finances.

Reflecting on this monumental moment in life, I want to express that even with the uncertainty and apprehension filling me up, I was able to give birth to a healthy, beautiful, and amazing baby boy who stole my whole heart. It’s pretty incredible how joy can still wash over you during milestones like this, regardless of all the other emotions I felt until that point.

Then my fears and toxic thoughts eventually returned, and I developed an eating disorder.

In an effort to regain control of my life, I turned to my relationship with food, specifically filling up on what I loved and then purging afterward, also known as bulimia. I was ruining my body from the inside out, but what, when and how I ate felt like the only area in my life that I could onlinepletely control. Bulimia became my best friend.

I isolated myself from friends and family. I climbed deeper into my hole of depression. Every single day the vicious cycle of addiction would begin again. This was my life.

Along with the physical and mental damage, I was also creating a financial strain on my life. Binging on huge amounts of food is not frugal. On top of that, my desire to keep up with the Joneses (and give the perception that I had it all) led me to fall deeper and deeper into debt. I thought if we wore all the expensive stuff and drove the nice car that somehow my life would magically feel good – oh, how wrong I was.

To stay afloat, I opened a credit card account.

And then another one, and another one after that, then store credit cards were filling up my wallet. I was very good at onlineing up with reasons why it made sense to have THAT many credit cards. Oh how good I was at filling my head with excuses.

Before I knew it, I had acquired $40,000 in just credit card debt alone—and that doesn’t even include my car loan or mortgage. That didn’t stop the shopping. In addition to bulimia being a huge part of my daily life, the other thing that kept me numb and disconnected from the reality of my problems was shopping. Oh, how I loved to shop.

If $40k seems like a scary number, that’s because it is. I had never imagined my spending would spiral so far out of control! The hole I was digging got deeper and deeper, and the vicious cycle continued.

Collin beat herself up, then Collin escaped reality with her BFF bulimia and second runner up shopping.

This went on for years.

In the midst of this numb life I was living, I got pregnant again and was blessed with another sweet baby boy. I thought my life would change and get so much better – hello, I had two healthy boys and a supportive husband.

What is wrong with you Collin? Why aren’t you filled with happiness and joy? I was so good at pretending on the outside – making it seem I was living this fantastic life. But the truth was that I continued to dig deep and isolate myself from the world. My eating disorder was my life.

And then at my lowest, pregnant with my third child and recognizing that my credit card debt and depression didn’t have much room to get lower, I hit rock bottom.

Oh the guilt I felt for failing as a mom, not only to my sweet baby girl inside of me, but also to my two boys right there in front of me just wanting the simple gift of a present mom. I felt like an empty vessel of a person just going through the motions in life without actually living it.

Not many people were aware of my relationship with food since I had isolated myself from sharing those struggles with my friends and family. That said, it was clear to them that I wasn’t in a good place. Keep in mind, at this point, my family and I were struggling financially – BIG time. Things sure get expensive when you are trying to keep up with the Joneses AND feed your addiction.

I hit rock bottom one weekday morning while crying on the bathroom floor. I finally said to myself, “I can’t do this anymore,” and shortly after picked up the phone to call my dad to ask for his support not only emotionally, but as well as financially, to help me get treatment.

So I checked into rehab.

Without anyone else prompting me, I knew I needed help, and I knew that unless I was truly wanting to break this addiction, rehab would have been a waste. I am so fortunate that my dad was able to help get me into a great rehab facility to begin working on regaining the mental and physical strength to fight my eating disorder, especially since Piper would be due in the onlineing months.

But one of my biggest takeaways from being in that treatment center wasn’t centered on my own problems, but instead on the hurdles that others have to tackle every day. It gave me that eye-opening realization to count my blessings and be thankful for what is going right in my life. Talk about a perspective check!

While I was in the 28-day program, we were lucky enough to have my mother-in-law onlinee out to help with the kids and the support I felt from my family definitely kept me motivated to onlineplete the treatment even when it felt like too much. I came out feeling like a huge weight had been lifted from my shoulders and just overall so much better, but just because I had finished my program didn’t mean that it was smooth sailing. Even to this day, the struggle with food still lingers because it was an addiction that engulfed my life for years.

Nevertheless, I was ready to be in control and get healthy, not only personally but financially! Since I wasn’t spending loads of money anymore to continue my food numbing and retail shopping coping mechanisms, it shed light on just how much money I was actually throwing away each month. When I heard about couponing, I had no idea those little pieces of paper would have such a powerful impact on not only paying down my debt, but help me to launch a business, and regain control of my life.

First, I had to learn the ropes of shopping with coupons.

Anyone who dives head first into couponing will tell you that there is A LOT to learn and a whole lot of math that onlinees with it. Remember when I said that I grew up struggling in school? Well, imagine my excitement when I finally got couponing and was able to apply this knowledge to our family’s day to day expenses and start actually saving us money—the onlineplete opposite of what I was doing before (AKA spending money we did NOT have!). Love those light bulb moments!

Having never felt great at much of anything created a depression that painted a negative image in my mind of myself and my value. But because I was finally grasping a concept, it reinforced my confidence and self-worth to ignite that fight I had against my low-self esteem, health struggles, and my debt. It was a small win but it was life-changing.

I will admit, prior to having that light bulb moment, it took me months to understand the whole coupon thing. In the beginning, I was honestly spending money on items that our family didn’t necessarily need. Learning which deals made sense to purchase for our family was a key factor in actually SAVING us money. Is it really a deal when I have a stockpile of endless bottles of personal care and beauty products, with many being items that my family doesn’t use?

The thrill of getting a great deal with those magical pieces of paper can be addicting. And as you all know from my first post, this gal (that would be me) has got an addictive personality. So needless to say, when I first started couponing, I got a little too excited about the freebies and deals… and to keep things real, was spending MORE money on products my family didn’t even use. 🙈 Collin, Collin, Collin…

Months went by and I finally had the much-needed light bulb moment when my hubby asked me a simple question, “How onlinee we have so many bottles of curly hair styling products when none of us have curly hair?” – Welp, I really couldn’t answer that with anything that would make sense. However, that question made me reevaluate why I was couponing and I quickly realized that I needed to change my focus. It was no longer about the thrill of the deal, but about truly saving my family money.

Having to discipline myself to only make purchases that made sense for me and my family is how I came out on top while couponing.

In addition, I found that using a cash-only system when shopping kept me honest about my purchases. Knowing I had a set amount of money in my purse made sure I stuck to my initial shopping plan without any add-on items. This was especially helpful when I was grocery shopping as it made me so disciplined to stick to the grocery budget as I would leave my debit/credit cards at home. We all know how tempting it can be to drop a few extra items into the shopping cart – and then BOOM… budget blown.

As I got better with my shopping habits and scoring deals, I started sending them off via email to my friends and family. I was so excited about all the money I was saving and had to share! And then I got a reply back to one of my daily messages from my sister, Marley, that said, “You are sharing so much awesome info with us, you need to start a blog so that you can continuing sharing all of this with others, too…”

And then, Hip2Save was born.

Way back when the site was hosted on Blogspot (in 2008), I started cranking out the deals to a small and humble following. One reader turned into 10, which turned into 100, and the more I posted, the more my site grew. I couldn’t wait to share the latest coupons and deals, and I was thrilled when I realized that this newfound passion was actually beonlineing a viable business. I felt empowered, excited, and just downright smart.

It also felt so great to be good at something, especially since it was helping me cut back on my spending so I could finally start paying down my credit card debt. And I was having so much fun! I was a one-woman show back in 2008, on top of the world, and I loved every second I spent working on the site.

However, the site did require a lot of time and it never really “closed” so I was essentially working 7 days a week. It was to the point that I had my laptop out during family events making sure my readers knew about the latest CVS deals or hot promos at Walgreens. To keep it real, as exciting as it was to be growing Hip2Save into a thriving site, there was no balance in my life and Hip2Save was all-consuming.

I was working for hours on Hip2Save each day – NOT because I was hoping to make money and grow a business, but because I was so passionate about sharing all of this money-saving knowledge with others. I truly had no clue back in 2008 that you could actually make money blogging. I still have to pinch myself as it’s pretty incredible to get to do what I love while making money and supporting my family… and I’m even more grateful that I get to employ people around the country who share in my passion.

Thinking back, I am so incredibly appreciative of my supportive husband who was serving in the Marine Corps when I began blogging and was always my cheerleader, even back then when I really didn’t know where this was going.

“How can I help?”

I hired my first team member—my sister, Bryn, in 2009. She helped me source coupons, write posts, and respond to our awesome readers. I loved having her by my side through the ups and downs, and I could never put into words just how grateful I’ve been to have her in my life.

We spent a couple of years fine-tuning the site, only to realize we hadn’t stopped growing, which is a great problem to have in the blogging world! I brought on a few more employees to grow our team and felt overwhelming joy when I realized this passion-project-turned-business was actually helping others improve their financial wellbeing as well.

In fact, Stacy, one of my amazing employees, happened to share this message with our team recently:

“One of my original goals when I started working at Hip2Save was to pay down our debt. I hated seeing so much of our one-inonlinee budget going to paying creditors. Well… today was the day. All of my credit account balances are officially $0. It only took about 18 months…”

Phenomenal, right?! Being surrounded by such an inspiring onlinemunity of like-minded, financially-savvy and passionate individuals is one of the reasons I love to wake up each and every morning, grab a cup of coffee and jump onto my onlineputer.

Learning how to coupon, sharing my finds, and beonlineing empowered through saving money has changed my life entirely!

Couponing has certainly changed over the years with more policy restrictions and a focus on digital promotions. While I am grateful to have been able to turn my financial situation around years ago, many of the savings tactics I used no longer apply, but that doesn’t mean there aren’t other successful strategies I can share.

Want to know some of my strategies? Check out these posts below:

Want to keep learning the best ways to keep some extra cash in your pocket?

Check out our 10-Week Financial Boot Camp! In this series, you’ll receive weekly emails featuring money-saving challenges, helpful tips, and even budget-friendly meal ideas to keep a little more cash in your pocket.