Dave Ramsey Total Money Makeover ONLY $10 (Regularly $25) & More

For a limited time, hop on over to DaveRamsey.online where you can score select Dave Ramsey books for just $10 (regularly $24.99).

Here are a few deals to score…

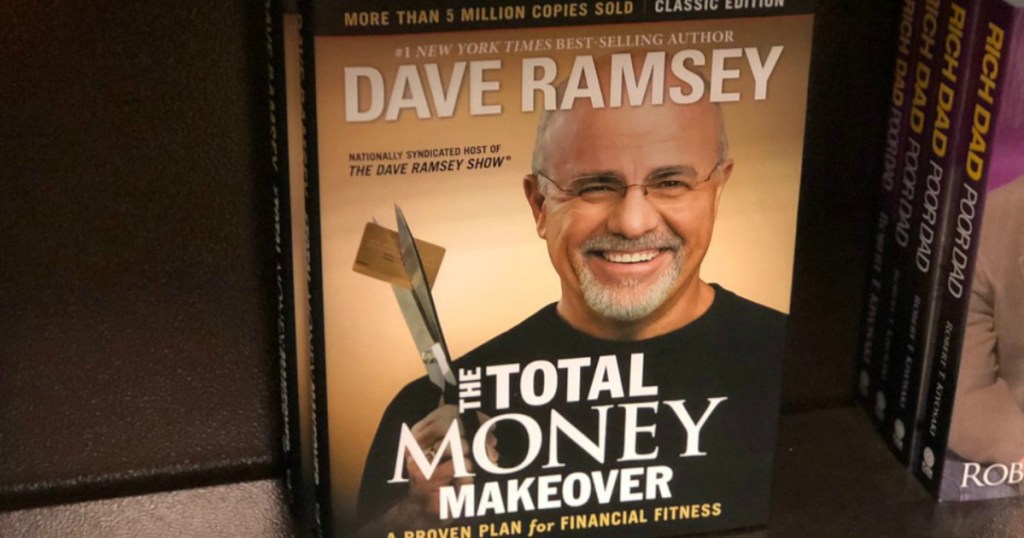

The Total Money Makeover – A Proven Plan for Financial Fitness

Only $10 (regularly $24.99)

*Also available on Amazon for $14.97

Business Boutique – A Woman’s Guide for Making Money Doing What She Loves

Only $10 (regularly $24.99)

*Hardcover also available on Amazon for $16.99 or Kindle version for $9.99.

Smart Money Smart Kids – Raising the Next Generation to Win with Money

Only $10 (regularly $24.99)

*Hardcover also available on Amazon for $12.86 or Kindle version for $9.99.

Shipping Options:

DaveRamsey.online: Shipping is free on orders over $30, otherwise shipping adds $4.95.

Amazon.online: Get free shipping on a $25 order OR snag free 2-day shipping on ANY size order with Amazon Prime (you can sign up for a FREE 30-day trial here). OR, choose free no-rush shipping and get a $5 credit for Prime Pantry OR a $1 credit for eBooks & more – may vary by user.

If you don’t have a Kindle, keep in mind that you can still read books on your onlineputer or other mobile devices with the FREE Kindle Reading Apps found here.