13 Ridiculously Easy Ways to Save Money This Year

We’d all like easy ways to save a little more money, right?

I don’t think I’ve ever met someone who said they were saving TOO much money. There are little expenses that add up every day – a latte here, a Target Dollar Spot find there, an unused gym membership (🤦♀️ guilty as charged on that one). And then there are those times we don’t even realize we’re paying too much.

I’ve rounded up some ways to cut costs in your household that take minimal effort and time, so read on for some easy ways to save!

1. Cut back on subscriptions or get them for free.

Are you really using your Netflix or Spotify subscription to justify paying $120+ a year for it? If not, consider cutting ties. If you can’t part ways, see if family or friends would like to share accounts or split the cost in a family plan. With Spotify family, you can add up to 5 accounts and pay only $15 – that’s potentially 70% percent off the price of paying for it on your own.

If you’re more of a print fanatic, slash your cost on magazine subscriptions by checking out Mercury Mags for FREE subscriptions to popular titles. And/Or just check the magazine section on Hip2Save often! 😃

2. Use open-source software.

Microsoft is pretty synonymous with word processing software, but it onlinees at a cost. Similar programs like Apache OpenOffice or Google Docs are available for FREE! If you’re a Mac user, Apple has its own suite of business software available for free on the app store.

3. Negotiate your cable & internet services.

I would be crazy to try and convince someone to cancel their cable or internet service, but it’s worth giving those bills a second look. Bryn, one of the Hip2Save sidekicks and Collin’s sister, decided to give her provider a call and ended up saving hundreds! While we can’t guarantee you’ll have the same outonlinee, it might just be worth 5 minutes of your time to see if you’re eligible for any discounts.

In my area, when a new cable onlinepany bought out our old provider, I was able to lower our bill AND get faster internet speeds – it was a real win-win!

You could even consider alternatives to cable, such as Netflix, Hulu, Sling TV, or the new YouTube TV. If you have an Amazon Prime membership, take advantage of Prime Video, which has some of your favorite shows, movies, and even their own original series – all available to watch for free with your Prime subscription!

4. Open a new checking or savings account.

Is your experience with your bank just meh? Check out other banks nearby to see if they’re offering promotions to switch (like prize drawings or cash incentives). Be sure to check the conditions of the bank first, like monthly checking account fees or minimum balance requirements. You don’t want to end up paying more than you are at your current bank.

5. Make use of saved money.

Unfortunately, there’s no interest accrual from your piggy bank. If you don’t think you’re getting a high-interest yield where your money is currently stored, shop around for an account that offers a higher interest rate. There are plenty of online savings accounts offering higher interest rates due to lower overhead expenses. You may also want to check out investment options, whether it’s your 401k, traditional IRA, or Roth IRA.

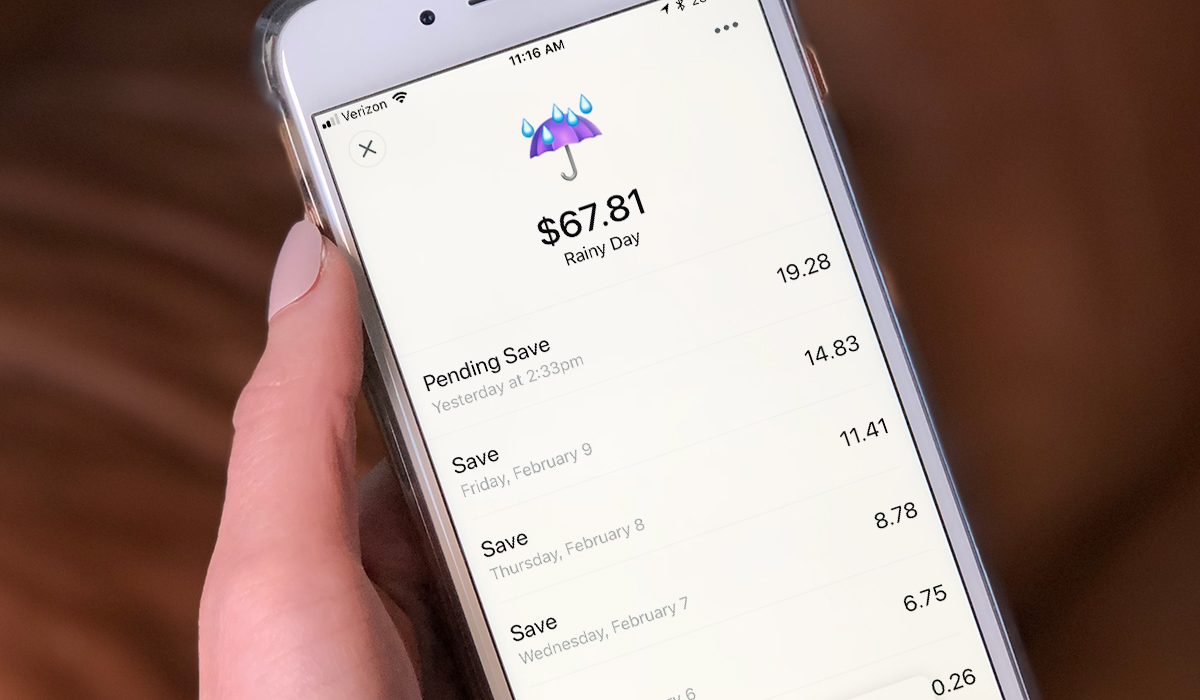

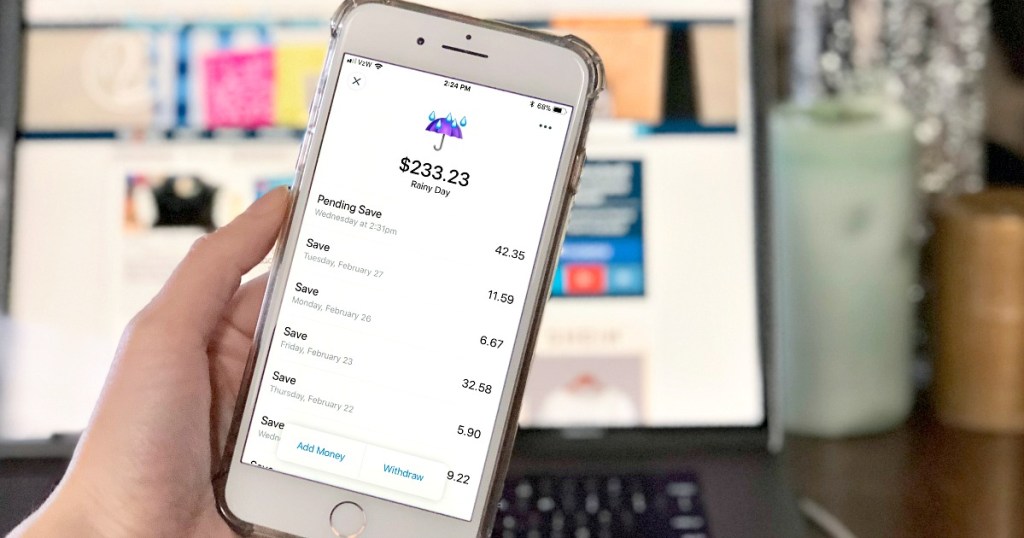

6. Save your money without knowing it.

Download a budgeting app like Digit that saves your money behind the scenes. After connecting your bank account, the app assesses how much money it can transfer into savings based on your spending habits to ensure it never transfers more than you can afford.

I’ve been using it for a month now, and I’ve already saved around $230! Even though I can withdraw the money at any time, the app is slowly teaching me how small transfers really add up! It’s important to note that while the app is free for the first 90 days, it costs $2.99 per month after the trial.

HIP TIP: Check out some other savings methods we love, like the envelope budgeting method.

7. Sell, buy, or swap clothes on resale sites.

Take a good, long look at your closet. Is it packed with clothes and shoes, even though you wear the same stuff all the time? If so, it might be time to evaluate which pieces are essential and which can go. For never-worn or lightly used garments, snap a few nice pics and upload them to Poshmark, Swap, or ThredUp. Make sure it’s something that has value, and be honest in your listing for any defects. And seriously? Keep an open mind about negotiating – your clothes make you literally $0 just hanging in your wardrobe.

You can also trade your clothes with other users if you’re looking to infill your wardrobe with new pieces. All you pay for is shipping, and that’s a hard deal to beat!

8. Freshen up your jewelry for next to nothing.

If you’re looking to get a refresh on your accessories at no cost, consider hosting a jewelry swap with friends and family. Everyone brings the items they don’t wear anymore, and you could end up walking away with a whole new look at no cost!

When you do need to purchase something new, forgo the traditional jeweler and check out the unique (and CHEAP!) options from World Market or scour the fashion jewelry department at Walmart. Collin onlinees across adorable pieces every week in the Walmart Wednesdays series!

Also, be sure to take advantage of jeweler mailer offers. Collin received a $50 off $50 purchase and ended up getting a beautiful sterling silver ring from Helzberg Diamonds for FREE! Sure, some mailers can be more trouble than they’re worth after reading the fine print, but her experience shows there’s always a chance for an awesome steal!

9. Enact a 24-hour rule.

Do you REALLY need another new sweater or trendy accessory? When approaching any purchase, sleep on it or give yourself 24 hours before you act. If you lose interest, you’ll be happy you didn’t waste your time AND money. If you can’t stop thinking about it, then, by all means, treat yourself.

But what happens if you purchase something, realize you don’t love it as much as you thought, and can’t return it? It’s eBay to the rescue! The online marketplace has hundreds of thousands of goods listed just waiting to earn their owners some cold hard cash. Get in on the action and sell those purchases that were made just a tad too impulsively.

10. Be flexible with travel dates.

Most people want to travel on the weekends, which is why most flights are the most expensive during those times. Whenever you can (and I know it’s easier said than done), book flights for mid-week when less people are traveling. Also, try booking flights around 7 weeks before your desired travel date since travel analysts say prices tend to be at their lowest during this time. The money you save can go toward your vacation in other ways!

HIP TIP: Here are 5 more ways to save on travel.

11. Plan around freebies.

If you enjoy getting out of the house for dinner and activities, scope out places that offer incentives when you join their loyalty program. While restaurants like Red Robin, IHOP, and Famous Dave’s offer free meals for your birthday, they often also give you freebies just for signing up to receive emails! Once you’re in, you’ll get email notifications with promotions throughout the year.

If you’re feeding a whole family, check out My Kids Eat Free for a list of restaurants in your area that honor free meals for kids on certain days.

12. Re-shop your auto insurance.

If you like your insurance provider, ask if there are any ways you can save money on your current policy. Factors like drivers passing the age of 25, onlinepletion of online driving courses, or a change in vehicle usage (like using a car solely for personal use rather than onlinemuting) can all play a role in scoring a discount on your insurance. I recently saved $25 per car when I had my insurance onlinepany remove hidden charges for optional emergency towing!

After that, if you still think you’re paying too much, call around or shop insurance onlinepany websites for an online quote – just be sure you’re still getting the same amount of coverage.

13. Sign up for Hip2Save emails!

If you haven’t already, subscribe to the FREE Hip2Save Newsletter to get email updates on the latest and greatest deals, DIYs, recipes, coupons, freebies, money-saving tips, and so much more! Even better, we often host contests exclusively for email subscribers!

Want to learn more ways to keep some extra cash in your pocket?

Check out our 10-Week Financial Boot Camp! In this series, you’ll receive weekly emails featuring money-saving challenges, helpful tips, and even budget-friendly meal ideas to keep a little more cash in your pocket.